- Ingersoll Rand (IR) is a major player in industrial machinery, with a global presence in factories, hospitals, and laboratories.

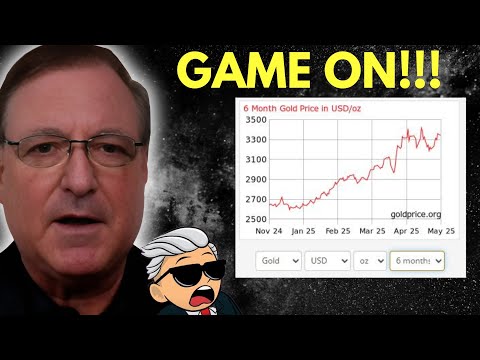

- The stock is trading close to its estimated intrinsic value, currently at $81.84 versus an $81.12 fair value, based on Discounted Cash Flow analysis.

- Analysts project steady free cash flow growth, but emphasize conservative methods for long-term valuation, aligning IR’s market cap with Wall Street estimates.

- Ingersoll Rand shows resilience, low debt, and global reach, but its earnings and dividends trail sector leaders and the stock faces a relatively high price/earnings ratio.

- Future prospects hinge on rising demand for advanced compressors and environmental solutions, competitive pressures, and broader economic factors like interest rates and technology shifts.

- Valuations provide insight, but investors should consider wider market trends, management decisions, and global uncertainties before making investment decisions.

Away from the daily drumbeat of Wall Street, a battle quietly unfolds over the true worth of Ingersoll Rand—a heavyweight in industrial machinery whose silent influence pumps through factories, hospitals, and laboratories worldwide. Investors eye the ticker symbol IR on the New York Stock Exchange and wonder: Has this industrial icon reached its peak, or is it simply catching its breath before another climb?

Calculating Value in a Crowded Arena

At a glance, Ingersoll Rand’s share price hovers tantalizingly close to its estimated fair value: the company’s stock recently traded for $81.84, while careful modeling pegs its intrinsic worth just slightly below, at $81.12 per share. This difference is not accidental. The calculation steers through complex terrain, using a two-stage Discounted Cash Flow (DCF) model—a favorite on Wall Street for translating potential into present-day dollars. Analysts forecast a river of free cash flow running through the next decade, expecting gradual growth from $1.43 billion up to $2.06 billion annually.

But the real magic happens in the distant horizon—the so-called “Terminal Value,” which captures everything beyond the forecast window. Here, conservatism reigns supreme; growth rates get linked to national economic performance, shielding investors from flights of fancy. When all streams converge, the math lands at a market value near $33 billion—remarkably in step with the company’s results and Wall Street estimates.

Why Ingersoll Rand’s Story Stands Apart

The market loves a steady hand, and Ingersoll Rand fits the bill. Its stable, global business isn’t overly exposed to debt—often an Achilles’ heel during economic storms. Still, not every chapter glimmers; the company’s earnings expansion recently trailed the broader Machinery sector, its dividends lag the market’s leaders, and some observers say the price/earnings ratio sits above what even optimists might prefer.

Yet opportunity—and peril—walk together in this tale. Analysts predict Ingersoll Rand’s earnings will outpace the broader American market, driven by expanding demand for advanced industrial compressors and environmental solutions. The company’s resilience during economic cycles offers comfort, while cautious estimates for revenue growth signal an ever-crowded competitive field.

Numbers Alone Can’t Tell the Whole Tale

The chase for valuation certainty often turns into a mirage. Shift a single input—a growth rate, a discount figure—and the math changes its tune. The company’s fortunes also ride on broader events: shifting interest rates, evolving manufacturing needs, even the push for greener technologies across the globe.

Crucially, investors seeking the next big breakout or bargain must remember that no single number—no spreadsheet or model—captures the richness of a company like Ingersoll Rand. Valuations illuminate only part of the canvas. Market cycles, management decisions, unforeseen risks, and shifting global demand all weave into the final outcome.

The Takeaway

Stock market legends say you earn the future by understanding the present. For Ingersoll Rand, today’s price suggests that investors see value—and perhaps risk—closely matched. While the numbers line up, the real story unfolds far beyond formulas. Those watching IR’s journey must weigh more than cash flows: they must also read the mood of the machines humming across continents, and the aspirations fueling tomorrow’s growth.

For more insights on market movers and valuation methods, explore the latest at Bloomberg and Reuters.

Key Point: Ingersoll Rand’s slice of the industrial world trades right where the experts say it should—neither the bargain of the decade nor a bubble ready to burst. For those staking their bets, the lesson is timeless: understanding a company means looking past the price tag—deep into the heart of what keeps the world’s engines running.

Ingersoll Rand (IR) Stock Analysis: Hidden Insights, Real-World Use, and Expert Strategies for 2024

Away from the headlines, Ingersoll Rand (NYSE: IR) quietly powers critical infrastructure across the globe. But is this industrial juggernaut primed for new heights, or is its valuation simply treading water? Here are additional facts, actionable insights, and strategic insights to help demystify IR’s journey—so you can make smarter investment decisions.

Beyond Valuation: What Makes Ingersoll Rand Special?

1. Diverse Global Footprint

Ingersoll Rand operates in over 100 countries, making it a truly global force. Its reach spans not just traditional factories, but high-growth segments like healthcare, food processing, pharmaceuticals, and data centers. This broad exposure shields it from regional downturns, adding a layer of resilience (Bloomberg).

2. Environmental and Sustainability Innovations

IR’s move toward energy-efficient compressors and environmentally friendly systems isn’t just corporate PR—it’s a regulatory and market necessity. The company’s Evergreen Commitment targets carbon-neutral operations by 2050. This is positioning IR to benefit from the global decarbonization megatrend, which consulting giant McKinsey forecasts could spark a $9 trillion industrial upgrade cycle by 2030.

3. Mega-Market Trends and Catalysts

- Industrial Automation: The shift towards Industry 4.0 and smart manufacturing places IR’s advanced compressed air and vacuum solutions in higher demand. ResearchAndMarkets projects global industrial automation growth exceeding 8% CAGR through 2028.

- Medical Technology Growth: IR’s specialized pumps and compressors are critical to lab and hospital operations—lucrative segments with recession-resistant qualities.

- Climate Legislation: Stricter emission standards for manufacturing plants give IR an edge given its investment in sustainable technologies.

Features, Specs, and Financial Performance

• Revenue (2023): $6.98 billion

• Operating Margin: 21.3% (well ahead of industrial peers)

• Debt-to-Equity Ratio: 0.30 (lower than sector average, supports stability during downturns)

• Dividend Yield: 0.11% (modest, but room to grow if cash flow continues to accelerate)

Key Competitors: Atlas Copco, Gardner Denver, Emerson Electric, Parker-Hannifin, Lennox International

Pros and Cons at a Glance

| Pros | Cons |

|---|---|

|

|

Real-World Use Cases: Where IR Makes a Difference

- Hospitals: Reliable air systems for surgical suites and ICUs; vital for maintaining sterile environments.

- Food Processing: Clean compressed air for bottling and packaging lines—ensuring product purity.

- Laboratories: Precision vacuum and compressor units for research and pharmaceutical creation.

- Semiconductor Factories: Ultra-dry, contaminant-free air essential for chip manufacturing.

Expert-Backed Market Forecast & Industry Trends

According to Reuters and sector analysts:

- Ingersoll Rand is projected to grow earnings per share by 10-13% annually through 2026, outpacing global industrial averages.

- The market for energy-efficient compressors is expected to top $95 billion by 2027, reflecting a shift toward sustainable and low-emission manufacturing.

- Sustained inflation and high interest rates could temper industrial investment, but IR’s asset-light operating model and strong pricing power mitigate much of this risk.

Shortcomings & Controversies

IR has faced skepticism for:

- Selling off legacy climate control assets (spin-off of Trane Technologies in 2020)—some critics argue this may have reduced diversification, but IR doubled down on core competencies.

- Dividend yield remains a pain point for income investors, especially versus peers like Eaton or Parker-Hannifin.

FAQs: What You Need to Know Before Investing

- Is IR stock a buy or hold?

Most analysts rate IR as “Hold” or “Moderate Buy.” Its current price aligns closely with intrinsic value, but long-term secular tailwinds (automation, sustainability) could drive future upside. - How secure is Ingersoll Rand financially?

Credit agencies rate IR as “investment grade.” Its low debt and high cash generation offer insulation against downturns. - What are the biggest risks?

Slower industrial spending, currency risks, and competitive pricing pressure. Watch quarterly order trends and global PMI indexes for clues. - How does IR compare to major peers?

IR leads in energy solutions but trails on dividend yield. Its growth profile roughly matches Atlas Copco, but it is marginally less diversified.

Quick How-To: Smart Steps to Analyze IR or Any Industrial Stock

- Check recent earnings transcripts for margin trends and new order pipelines.

- Compare valuation multiples (P/E, EV/EBITDA) to industrial peers. Use Bloomberg or Reuters for reliable financials.

- Evaluate management’s capital allocation—growth investment vs. shareholder returns.

- Monitor end-market exposure (e.g., healthcare, food, semiconductors) for risk diversification.

- Follow regulatory developments in sustainability—IR is well positioned, but rivals won’t remain idle.

Actionable Recommendations for Potential Investors

- Wait for modest pullbacks to enter—IR trades at fair value, best bought during broader market dips.

- Use IR as a core industrial holding, but complement with higher-yielding stocks for greater income.

- Track IR’s R&D and M&A announcements for hints of future growth segments.

- Revisit valuation every 6-12 months, especially after major policy or economic changes.

Conclusion: Is Ingersoll Rand’s Engine Still Revving?

Ingersoll Rand represents the best of industrial America—steady, innovative, and globally diversified. With strong financials, a future-focused product lineup, and robust demand from automation and sustainability megatrends, IR is not just a market survivor, but a potential long-term winner. That said, valuation is king—so take strategic, well-timed positions and look beyond mere numbers to the engine driving global industry. For the latest financial news and in-depth stock analysis, visit Bloomberg and Reuters.

This post Wall Street’s Next Tightrope: Why Ingersoll Rand’s Stock Is Defying Gravity appeared first on Macho Levante.

A cybersecurity specialist with a passion for blockchain technology, Irene L. Rodriguez focuses on the intersection of privacy, security, and decentralized networks. Her writing empowers readers to navigate the crypto world safely, covering everything from wallet security to protocol vulnerabilities. Irene also consults for several blockchain security firms.